- Print

- DarkLight

- PDF

REFINANCING

1. Purpose

Refinance feature helps business users to process contract roll-over, i.e., close old contracts and refinance the pay-out figure via new contract.

This can be used in different business scenarios:

- Loan restructuring

- Refinance of residual value

- Finance new equipment and include pay-out of old contract.

Activation of new contract drives termination of old contract.

2. Required Setup

On Leasing Posting Setup input Refinance Clearing account. It is used as a transit account between old contract termination (debit posting) and new contract activation (credit posting)

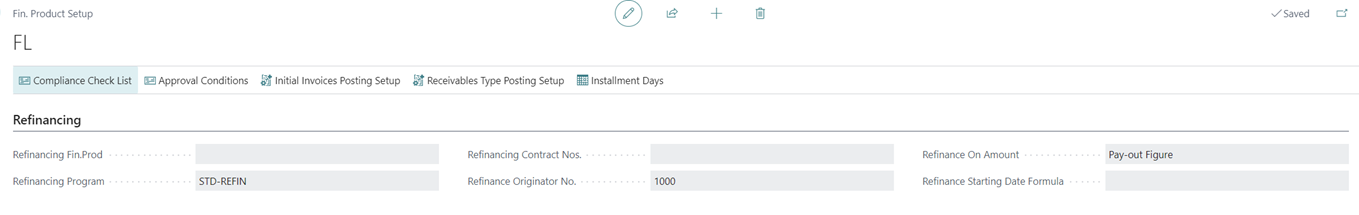

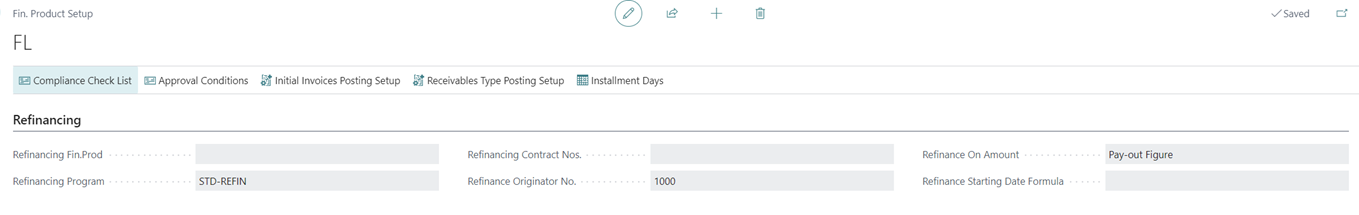

On Fin. Product Setup page, optional values:

Refinancing Fin. Prod - by default refinance-to fin product code (if blank – will refinance to the same product, FL to FL in this example). Business may set up separate products for refinanced deals e.g., “FL” would refinance to “FL-R”.

Refinancing Program - by default refinance program (if blank – will refinance to the same program). Businesses may use higher interest rates (i.e., different program) for refinanced contracts.

Refinance Contract Nos - number series for refinanced contracts (if blank – will use standard numbering sequence). Businesses may use separate numbering for refinancing contracts.

Refinance Originator No. - replacement of Originator No. for refinance (if blank – original originator of old contract stays). For example, the contract originated by the dealer, but refinance is always done by Direct Sales, or Credit dep.

Refinance On Amount – businesses may choose to which amount to refinance, Outstanding Principle or Pay-out Figure.

Refinance Starting Date Formula – formula for schedule staring date.

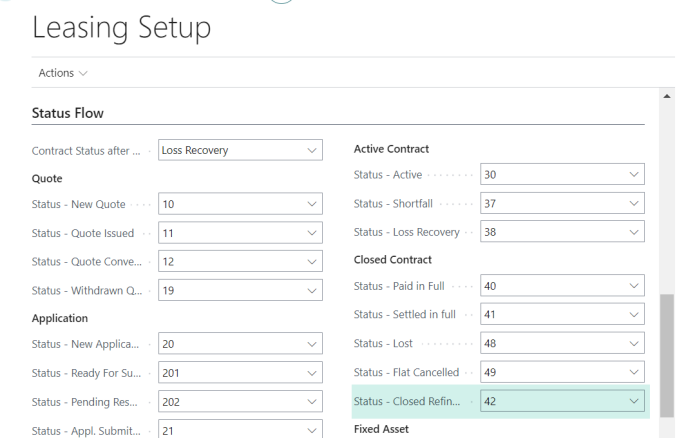

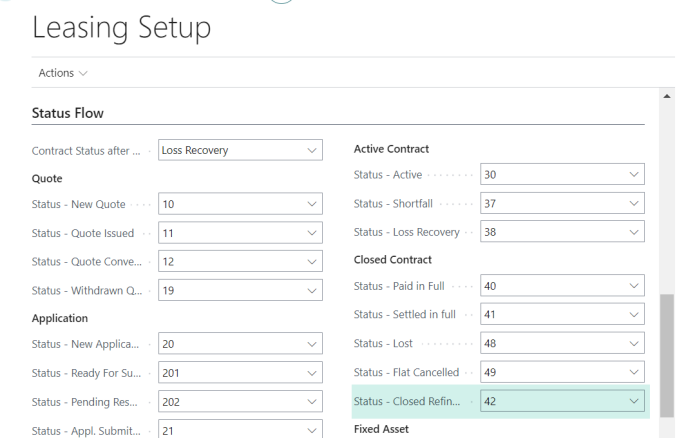

On Leasing Setup page, input the status code for refinanced contracts. It is used on old contracts, which is closed because of refinance (i.e., “Closed – Refinanced”).

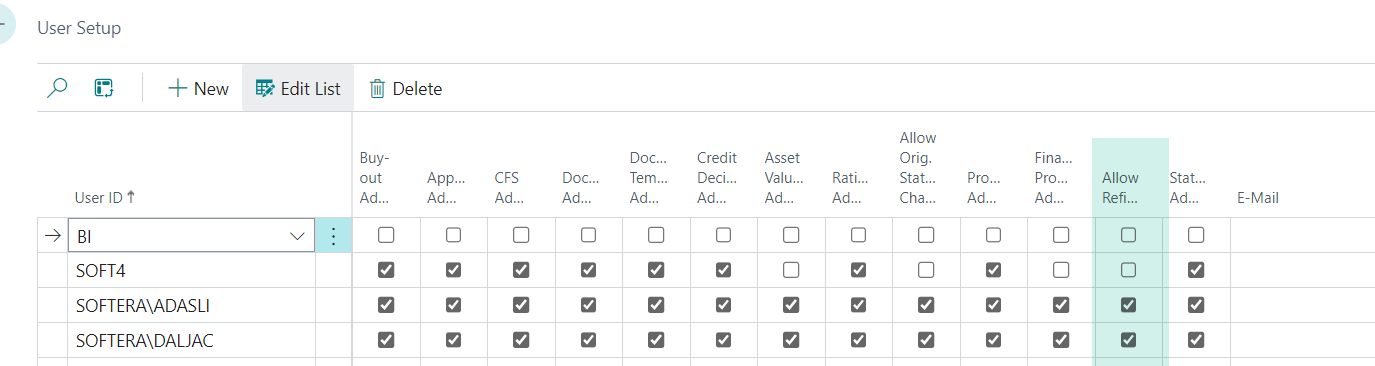

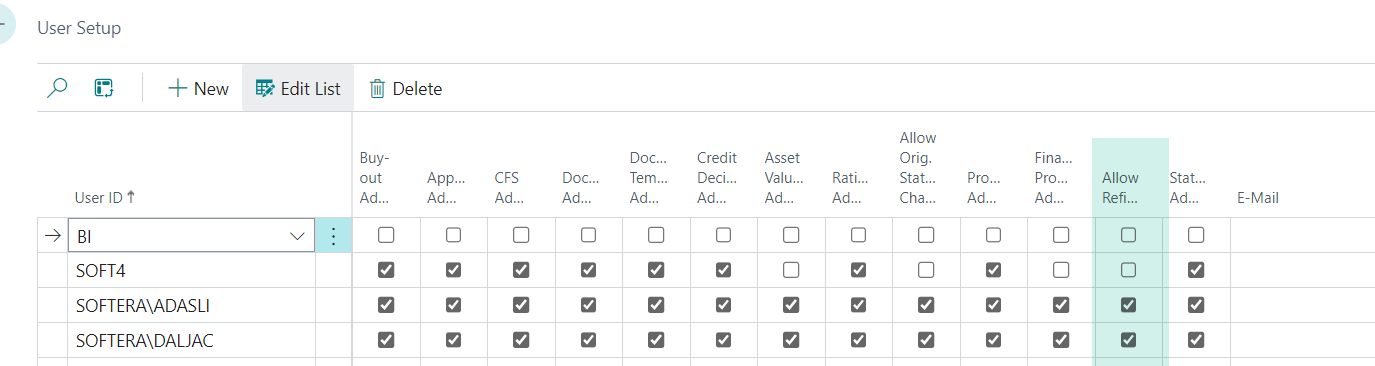

On „User Setup“ page, set permission for users to allow refinance. This allows functions „Create refinance“ and allows activation of refinancing contract.

3. How to process Refinancing

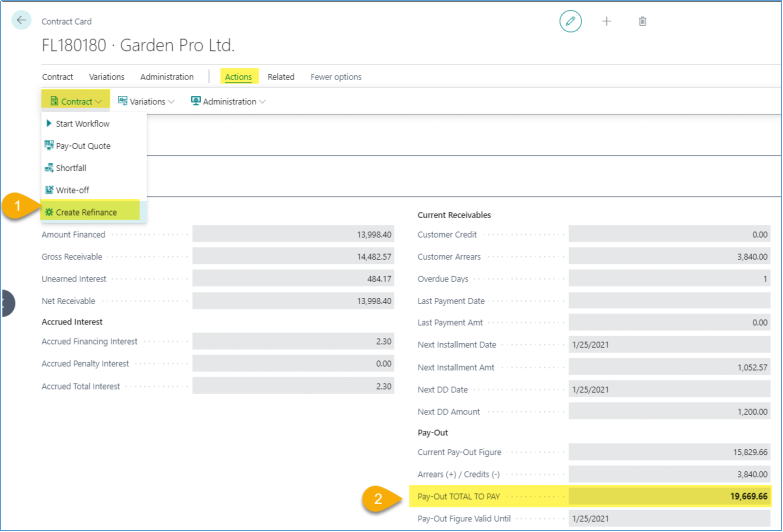

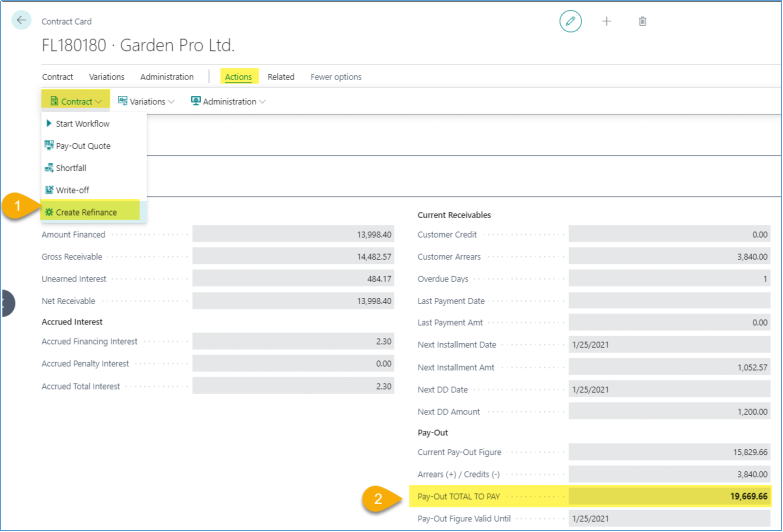

- On old contract (“to-be refinanced”), use function Create Refinance [1]

This will create a new application for the same customer, on Pay-out figure of old contract [2], including any arrears or overpayments on old contract.

Create Refinance function will as for confirmation…

…and give ending message, indicating the number of newly created application.

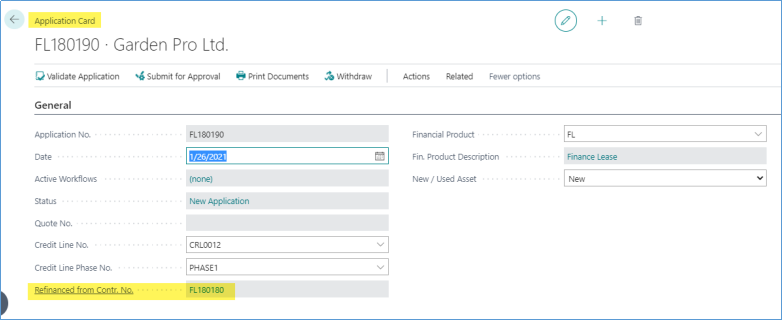

Old contract will stay active, until new contract gets activated. The two are linked via Refinanced to Contr. No. and Refinanced from Contr. No. fields. Lookups on these fields will bring-up the related application/contract.

- On new application (Refinance application)

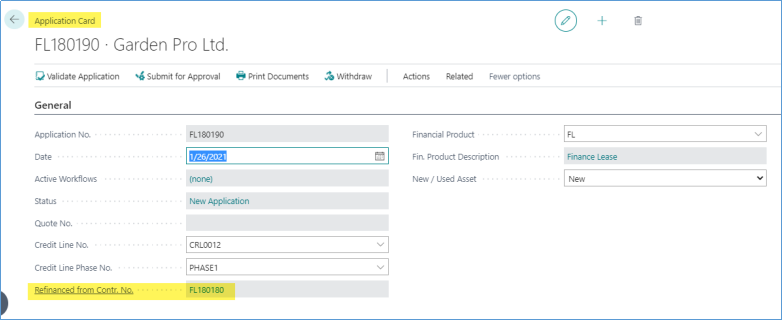

On new application, the field Refinanced from Contr. No. indicates old contract number, drillable.

On new application, Schedule page, the field Refinance pay-out is auto populated and must match with pay-out figure (including customer current arrears) of the old contract

On new application, Assets page, the asset description gets prefix “Refinance of…”, followed by original asset description.

- Activation of Refinance application

Follow regular process of application approval.

Follow the regular process of contract signature and compliance check.

The specifics of Refinance case are the Activate function, as it will auto-terminate old contract on activation of the new contract.

When activating the refinance contract, the confirmation message is different from regular:

And you may get success message.

Or, error message like this

This error message may happen if the balance of the old contract has changed in between Create Refinance function, and activation of new contract. If this happens, you must manually update amount on the application.

- The results of refinancing process

When refinance application in progress, it is visible in “Refinance Applications” tile.

When refinance is finished, old contract will close and show in “Closed – Refinanced” tile. Newly activated contract will show in “Active Refinancing” tile.

The General ledger sample:

[1] termination postings on old contract

[2] activation postings on new contract

Balanced via “Refinance Clearing” account.